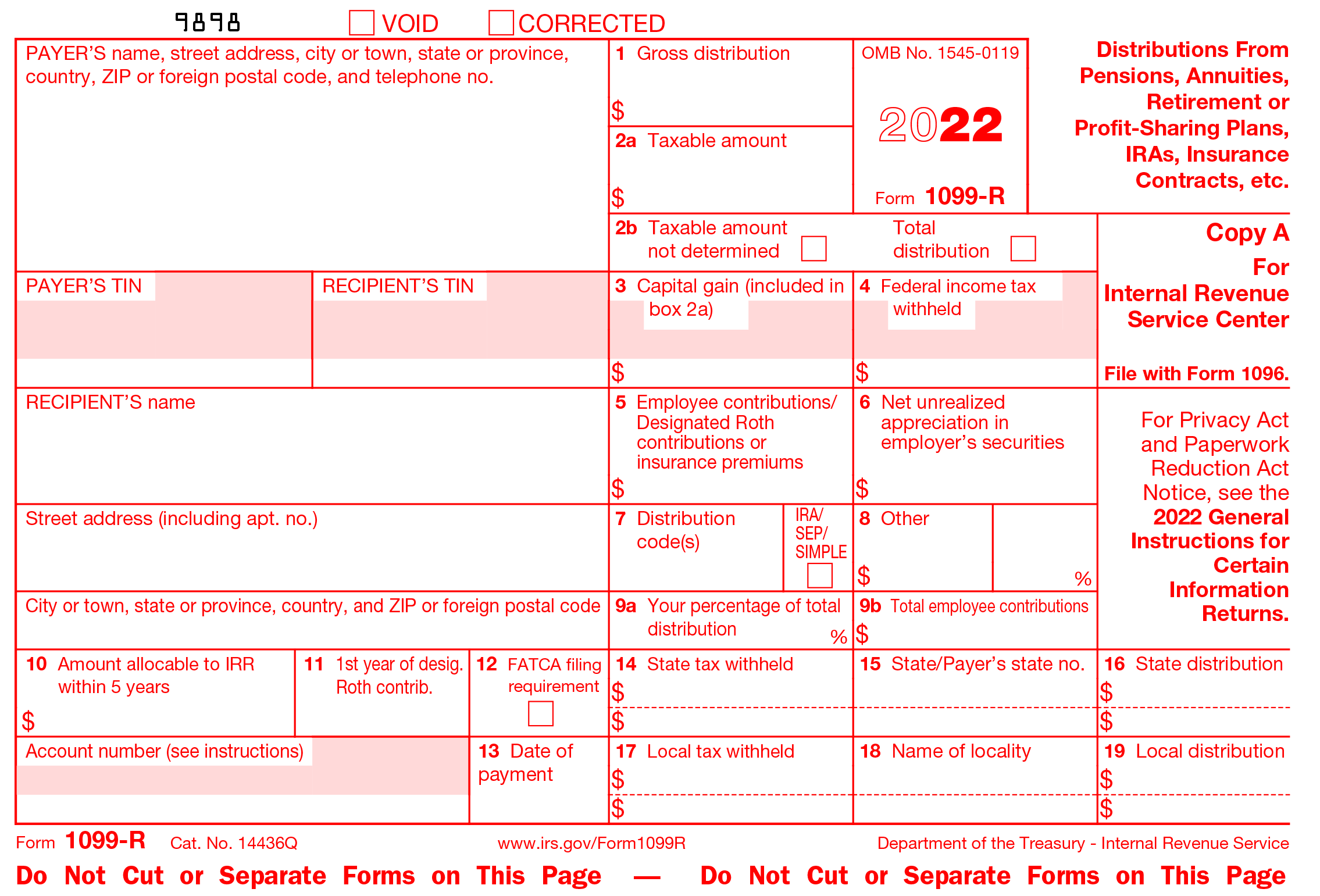

IRS 1099-R FORM -

E-FILING MADE EASY

The best online software to report the distributions from retirement benefits.

E-File 1099-R NowThe IRS 1099-R Form Filing Deadline

Deadline for mailing copies to recipients:

FEBRUARY 15, 2023

Deadline for paper filing with the IRS:

February 28, 2023

Deadline for E-filing with the IRS:

March 31, 2023

What is IRS 1099-R Form?

IRS 1099-R Form is the version of 1099 Forms that is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, charitable gift annuities, and insurance contracts. Form 1099-R is filed for anyone who has received a distribution of $10 or more from the mentioned items. A copy of the form must be mailed to each recipient and filed with the IRS.

Learn more about IRS Form 1099-R.

METHODS TO FILE IRS 1099-R FORM

Paper Filing

If you paper file Form 1099-R, you print out the correct form then fill it out by hand and hope it's correct. Then you will mail it to the IRS and your recipients. The IRS will not notify you if they have accepted your form, but you will be notified via mail if it's rejected.

E-Filing

You can also conveniently file Form 1099-R online. The form will be provided along with instructions on how to complete it. Then you can safely and securely transmit it directly to the IRS. You will receive live status updates about your form via email and can instantly make corrections if need be.

Advantages of E-Filing

- Reduce paper works

- Greater Accuracy

- Avoid delays & filing errors

- Fast confirmation

- Apply from anywhere at any time

- Cost-effective e-filing

- TIN Matching

1099-R Filing Requirements

Completing IRS 1099-R Form is easy, simply provide the following required information:

- The payer details such as their name, EIN, address, and contact information

- The payee details such as their name, SSN, address, and contact information

- Federal details, including all distribution received and federal tax withholdings

- State details, including state name, state ID number, and state tax withholdings

Visit, https://www.taxbandits.com/1099-forms/efile-form-1099-r-online/

About IRS1099R.COM

IRS1099R.COM is your number one option when it comes to filing Form 1099-R online . Our program is IRS authorized, meaning you can trust that your information will be kept safe and secure. Plus, our e-filing instructions will guide you through the whole process and our outstanding features will ensure that it's headache free! We put your e-filing needs first in order to help simplify tax season.

irs1099r.com Features

Bulk Upload

Instantly upload all of your information at once with our bulk upload feature. You can use your own Excel file or our template to import all your data and save time! Manually entering in information one by one is a thing of the past!

Postal Mailing

Don't deal with the hard work of mailing copies of your forms out. Let us take care of it for you. Use our postal mailing feature to have our outstanding team send your recipient's copies of Form 1099-R for you.

Error Checks

Before you transmit IRS 1099 tax form R, it will go through our built-in error checks to catch any basic mistakes. This is to reduce common errors and ensure as much accuracy as possible.

IRS 1099-R Form E-filing Steps

You can e-file Form 1099-R in no time. Just refer to the following steps:

- Step 1: Get started by creating your free account use your personal email and password.

- Step 2: Then enter your payer details include their name, EIN, address, and contact information.

- Step 3: Next you will enter your payee details include their name, SSN, address, and contact information.

- Step 4: After that, enter the federal details, including all distributions received and federal tax withholdings.

- Step 5: The last thing you'll enter is state details, including the state name, ID number, and state tax withholdings.

- Step 6: Last but not least, review your information, pay for your form and transmit it to the IRS.

IRS 1099-R Form Extension

If you need more time to file Form 1099-R all you need to do is file extension Form 8809. By filing Form 8809 by the Form 1099-R deadline you will receive an automatic extension of 30 extra days to file!

Learn more about Form 8809.

IRS 1099-R Form Corrections

If you need to correct your Form 1099-R you will need to file a new form as soon as possible. You will need to submit the corrected form to the IRS and you will need to send new copies to your recipients via postal mail.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form. With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now andrequest the first FIVE Form W-9 for FREE.

Contact Us

If you need any help with Form 1099-R simply contact our dedicated, US-based support team. We're ready to answer all of your questions during any step of the process. Give us a call, reach us via live chat, or use our 24/7 email support.