Deadline to E-file Form 5498 is

June 30, 2023.

What Banks & Financial Institutions should know about Form 5498?

E-file with IRS-Authorized Provider

Introduction to 5498 Series

If an individual work for any organization & if the employer doesn’t provide the employer-sponsored retirement account like a 401(k) or 403(b), then they can avail any individual retirement benefits that are available in the market. One such common and most used retirement plan is the IRA (Individual Retirement Account).

The Organization such as Bank or any Financial Institutions which manages these individuals retirement account is generally termed as Custodian.

Custodian is responsible for managing the IRA accounts and provide them with any distributions for the respective individual's retirement account. These custodians are also responsible for reporting the distributions made to the individuals to the IRS through Form 5498. The copies also need to be sent to the participants.

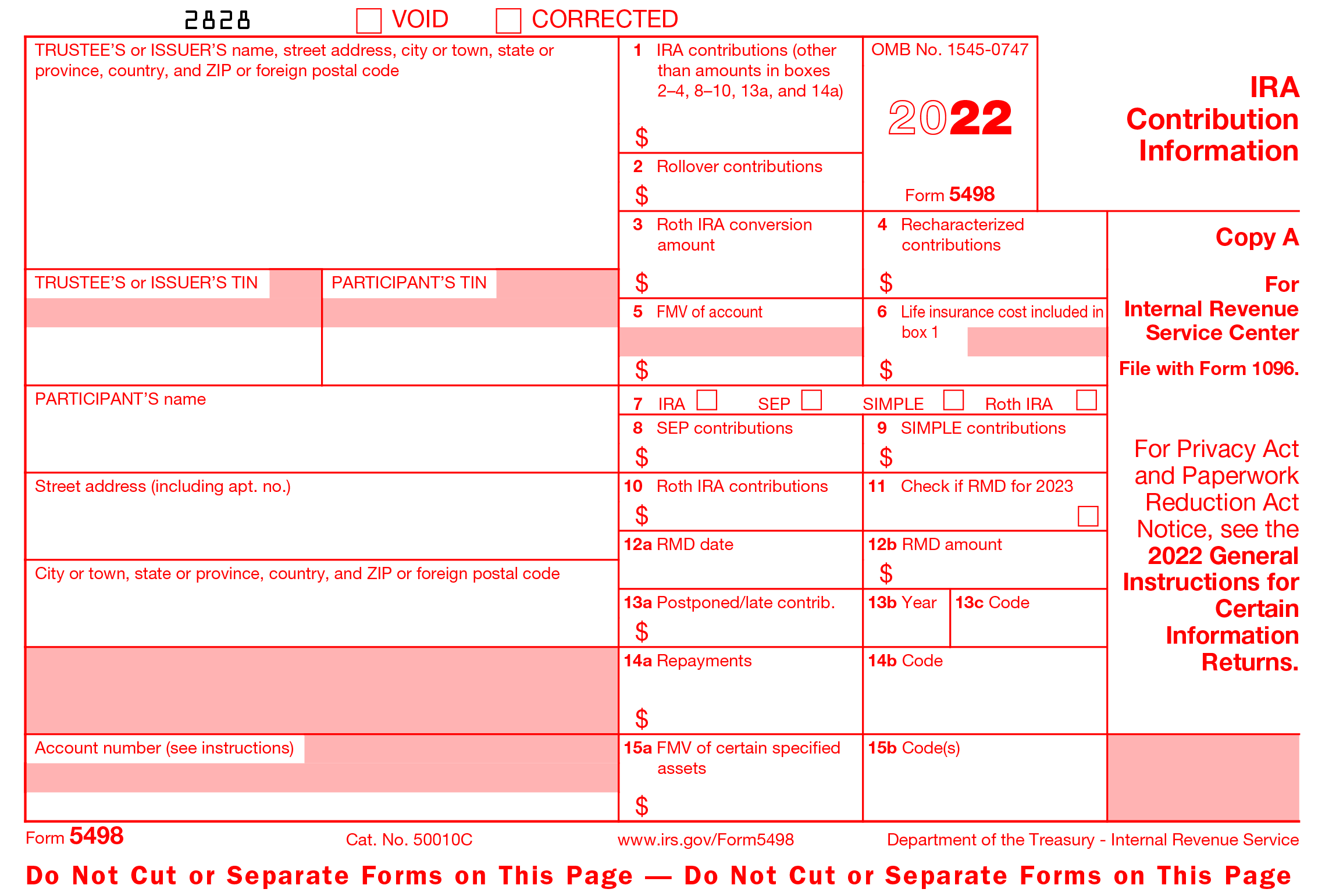

Form 5498 - An Overview:

Form 5498 provides information about IRA contributions, rollovers, traditional & Roth IRA conversions and required minimum distributions (RMD).

You’ll need to provide details about any distributions you’ve made to the employees for a Savings Incentive Match Plan for Employees (SIMPLE IRA) or a Simplified Employee Pension (SEP-IRA).

If an IRA is revoked, or an account is closed between the tax year, the contributions must be reported on Form 5498.

Visit https://www.taxbandits.com/form-5498-series/what-is-form-5498/ to know more about IRS Form 5498

Variants of Forms 5498

Form 5498 varies based on the account type

- Form 5498 IRA Contribution Information reports information about individual retirement accounts such as traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRA plans.

- Form 5498-SA reports information about health savings accounts (HSAs).

- Form 5498-ESA reports information about Coverdell Education Savings Accounts.

If your employees didn't make any contribution to a traditional IRA, SEP-IRA, SIMPLE IRA, Roth IRA contract during the tax year, Form 5498 will not be required.

When do you need to report these 5498 Form?

Due to the participant

(Only for FMV

& RMD)

February 1, 2023

Due to the participant

(Other types of IRAs)

June 30, 2023

IRS Filing

June 30, 2023

IRAs contribution must be reported with the IRS before June 30. Contributions for the previous tax year made up until May 17 are included on Form 5498 for traditional and Roth IRA accounts, so many IRA account holders won't receive this information until June.

- Due to the participant by:

June 30, 2023. - E-File Form 5498 SA with the IRS by:

June 30, 2023.

- Due to the designated beneficiary by:

June 30, 2023. - E-File Form 5498 ESA with the IRS by:

June 30, 2023.

Learn more about the 5498 Deadline for 2023 .

Information to Include on Your 5498 Tax Return

- Trustees or Issuers’ details such as Name, TIN, Contact Information

- Participant’s details such as Name, TIN, Contact Information

- IRA Contributions details

- Review, Pay & Transmit Form 5498 directly to the IRS.

With these information, the participant can proceed to fill the boxes in Form 5498. About 20 boxes are there to report the IRA, RMD, Rollover contributions.

Visit https://www.taxbandits.com/form-5498-series/form-5498-instructions/ to know more about

Form 5498 instructions.

How can you simplify the 5498 filing process?

E-Filing is the best choice to File Form 5498. You can look for the trustable e-file providers to manage your 5498 online filing effectively. TaxBandits.com is one of a trusted source for e-filing your 5498 returns with the IRS.

Also, you can avoid a bunch of paper works, save your time and avoid last minute rush and Form errors. You will be notified about the IRS acceptance status of your 5498 return within a short time.

Why should you choose TaxBandits for Filing your 5498 Online?

- Affordable pricing that saves your filing cost. You can file your 5498 Form electronically with the IRS within just a few minutes.

- You have the option to send a copy of your Form 5498 to your participant with our print and postal mail feature right from your TaxBandits accounts.

- You can provide access to the other members in your organization for managing Filing on your behalf and also track their activities.

- With our print center feature, you have access to all your returns all the time. You can access copies from anywhere and print it anytime.

And with TaxBandits , you can also manage and file the other tax forms like W-2, 1099,

ACA 1095, and 94x.

Get started now with TaxBandits and e-file the 5498 Forms .